Ever since Nixon took the US Dollar off the gold standard the world has been running on borrowed money...

AND TIME!

Now the US Dollar has nothing to back it except for shaky promise.

A promise that the US economy will never stop growing...

And the debt can never run out.

So for over five decades, the US has been blowing up the two balloons.

One balloon for bonds.

And another balloon for M2 Money.

Sometimes they have been pumping debt into them slowly, sometimes in a very fast way.

Like during the pandemic.

You saw how the US government printed over $8 Trillion in only a few years.

And they pumped it directly into the M2 Money balloon.

That's 40% of the US Dollars EVER printed.

And no one expect this balloon to pop?

Some do.

I'm willing to bet that's why you're here.

You know there has to be an alternative.

So way out.

Well, as it turns out there is...

And it's already slowly happening.

Because we know the fiat system is failing to secure our purchasing power.

It's a revolution in money, finance, and economics.

Investors are slowly moving their money out of fiat-driven stocks and bonds, and into gold and Bitcoin.

Here's what that looks like:

The truth is...

The bankers, the elites, and the politicians hate Bitcoin because they don't want to lose the power of the printing press.

Even though all fiat currencies are breaking down...

You've probably already felt it.

The uneasy tension about the economy during the last US election....

Uncertainty about federal payments on debt - Now over $1 Trillion per year.

That's over 70% of all income tax.

And neither candidate has any solid plans to stop government deficit spending - Now, over $2 Trillion this year.

Then there's Trump's concern over US dollar destruction.

To try his hand at duct-taping dollar destruction his willing to bully the world.

Trump recently said:

That's because he views fighting for fiat dollar supremacy as "all out war."

At The Economic Club of New York he told the room:

The thing is, despite all of the government's efforts to maintain the dollar as the world's reserve currency, it's still not working.

Money is slowly flowing from the $20 Trillion US dollars floating around the world, and the $120 Trillion global bond market into hard assets - gold, and Bitcoin.

Here's how you can tell.

Most people look at the price of Bitcoin and think, "Look at that bubble." It's nothing more than Tulips."

To non-coiners, when they look at the Bitcoin chart, that's how it appears.

They say...

I see Bitcoin like gold bugs see gold.

It's about what we are using to account for everything...

It's about fiat money - including the US dollar.

Fiat money is on the decline everywhere.

Although it may look like Bitcoin is an obscure, volatile, and risky new "asset class."

It is not.

See the Y axis?

Bitcoin's purchasing power is increasing exponentially.

Imagine what this will look like on it's regular chart...

"Volatile..."

"Obscure..."

"Another risky crypto investment..."

When that is far from the truth.

Every fours years Bitcoin does THIS...

It's over, or almost 10X what it is was four years before....

In 2012, Bitcoin was flirting with $100...

In 2016, Bitcoin was eyeing up $900...

In 2020, Bitcoin was crossing the $10,000 hurdle...

Now, we're look at passing the $100,000 threshold...

When you look at Bitcoin versus fiat money.

Bitcoin is slowly, and soon suddenly becoming the baseline for a new monetary order.

While fiat enters unsuspecting hyper-inflation mode.

If that still sounds like noise to you...

Here is What's Happening Right Now...

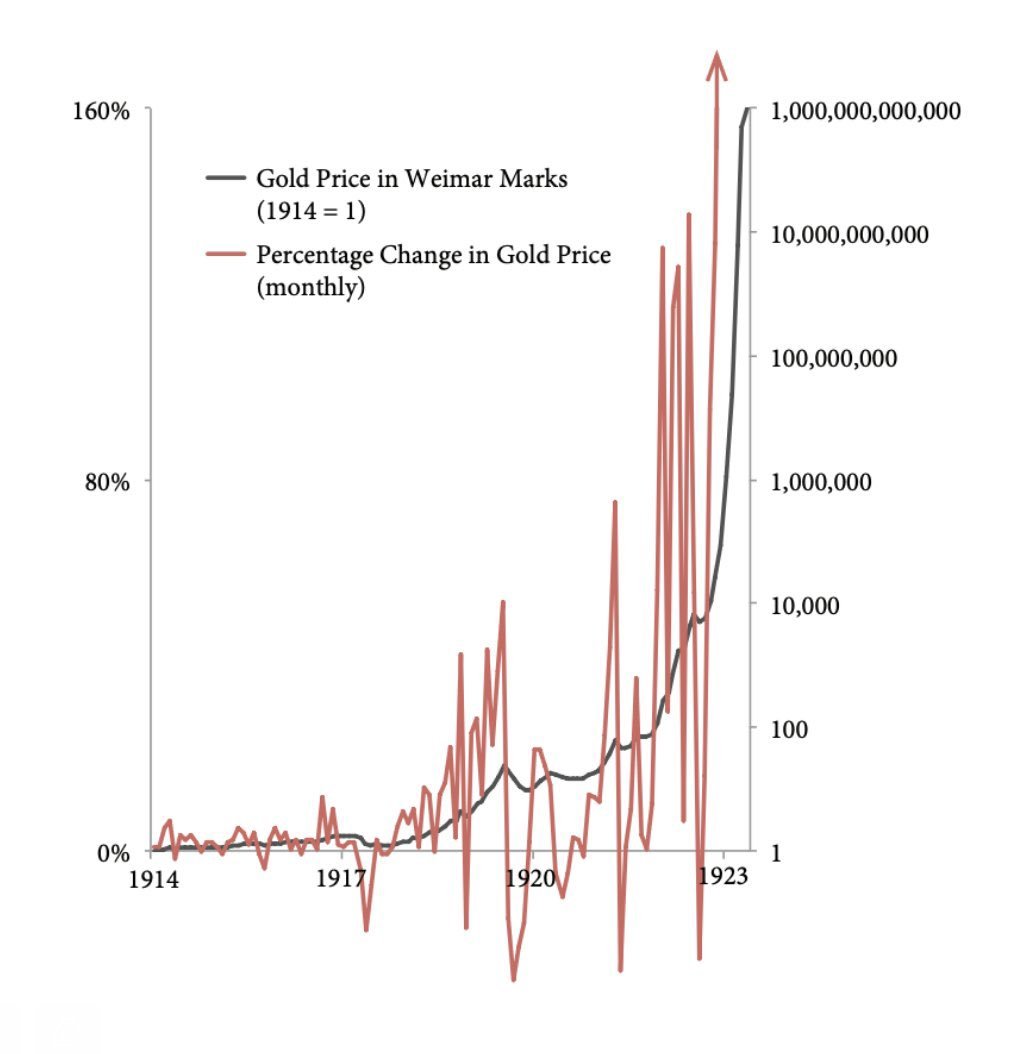

It tracks the change in gold prices vs. fiat paper marks.

You see how gold marks made massive swings in paper-fiat pricing?

That's what the general horde of investors sees.

They see nothing, but volatility.

You see something different...

What we see is the slow, steady, albeit volatile takeover of of a new monetary order...

One where gold once again became the baseline for Germany's currency.

The same thing is happening with Bitcoin.

A new monetary order is emerging where Bitcoin reigns supreme.

Because the higher Bitcoin becomes valued in fiat money, the harder it will become to know how much you should actually pay for...

Anything!

At some point inflation goes parabolic (almost straight up) and pricing...

Anything...

Actually, EVERYTHING becomes unmanageable.

The same thing has happened to several other currencies...

Zimbabwe...

Venezuela...

And yes, Weimar Germany, which is why you to prepare your portfolio now.

That's because I've used it to build wealth since before inception of Bitcoin, and after...

Once I heard the word's "invest in real things," I said to myself, "that's my religion."

You could call it a rule for life, which is why I want to send you:

Like Saylor, I started allowing my tech businesses to receive Bitcoin in 2013, but I bought it even earlier.

When I started looking into publicly-traded Crypto-stocks in 2018-19, I found something interesting - Ben Graham-style value investments.

When you looked at the value with Bitcoin, many crypto-stocks were trading way below actual value on their balance sheet.

This stock is no different, except for one thing you may, or may not have seen before...

The Bitcoin Capitalist Crash Course...

- A full 15 page walkthrough on the 3 pillars of Bitcoin Capitalism - Protects you and your family from inflation, the loss of purchasing power, and the wrong side of history, while preparing you for prosperity.

- Bitcoin explained. And how to make a healthy profit from it - step-by-step.

- Zero "Why Bitcoin" Spiel. All actionable insights into how to buy Bitcoin, safely self-custody, and how to indirectly invest in Bitcoin through you traditional broker.

- Where can I find good sources of information about Bitcoin? 3 Book Recommendations. Plus, download The Crypto Capitalist Manifesto, and The Best Bitcoin Book Ever Written, free.

- Is it too late to invest in Bitcoin? More than a simple "yes or no" answer. Here's what you would get. Here's a simple timeline. And a prediction on what Bitcoin could look like by 2038. (page 2)

- What should I invest in? One thing only. Where to buy it, and secretly if you really want to. So the Fed's can't track you. How frequently you should buy it. (page 4)

- How can my business accept Bitcoin? It's easier than you think. I've been doing it at my main business since 2013. Want to guess how much the corporate treasury is worth now? (page 8)

- What is a cold wallet? Basically, your own bank account. You become your own bank. Inside you'll you have access to a 10-year-old girl setting up hers. 3 recommended wallets (page 9-10)

- What Crypto Stocks should I buy? You don't have to stick to ETFs. There are specific, young, under-valued crypto stocks waiting for you to arbitrage their value. Much like MicroStrategy.

- Should I use debt to buy Bitcoin like MicroStrategy does? Some companies use sophisticated strategies to trade fiat for Crypto. Here's what to do instead (and still make similar amount of money).

BONUS #2: Exclusive invitation to pre-launch pricing for easyCoin. Premier payment software that allows you and your business to accept Bitcoin on the books.

BONUS #3: FREEE DOWNLOAD - The Simplest Bitcoin Book Ever Written. A point-by-point breakdown on Bitcoin from start to finish. Why Bitcoin, and what it is, and how it's going to change the world.

Plus, a one-time invitation to become a Bitcoin Capitalist at a never-berfore-seen discount.

Tyler Durden, ZeroHedge

Charles Hugh Smith, Oftwominds.com

Steve Bannon, Warroom